Inflation is one of the most underestimated forces affecting long-term wealth. While market volatility often captures attention, it is inflation — the gradual increase in

When it comes to investing, most people believe they make rational, logical decisions based on facts, research, and numbers. In reality, decades of research in

When people start exploring superannuation structures, the conversation often begins with one statement:“I want to use my super to buy property.” In many cases, the

When people think about investing, they often focus on returns — growth, dividends, interest, and performance. However, what truly shapes your long-term outcome is what

When markets are rising, investing feels straightforward. When markets fall, urgency and doubt creep in. Headlines grow louder, predictions become bolder, and many investors ask:Should

A Comprehensive Guide for Adelaide Clients Considering Financial Advice For many people across Adelaide, booking a first financial advice meeting is a significant and important

Searching for a “financial planner Adelaide near me” usually means one thing: you’re ready to speak to someone now, not just read generic information. If

Financial Planner vs Accountant: A Guide for Adelaide Clients When it comes to managing money, many Adelaide clients ask the same question: Do I need

Superannuation is one of the most valuable financial assets most Australians will ever have. Superannuation is also one of the most valuable financial assets for

Transform Your Financial Future Today

Partner with MoneyPath for tailored strategies and expert guidance to achieve your financial goals.

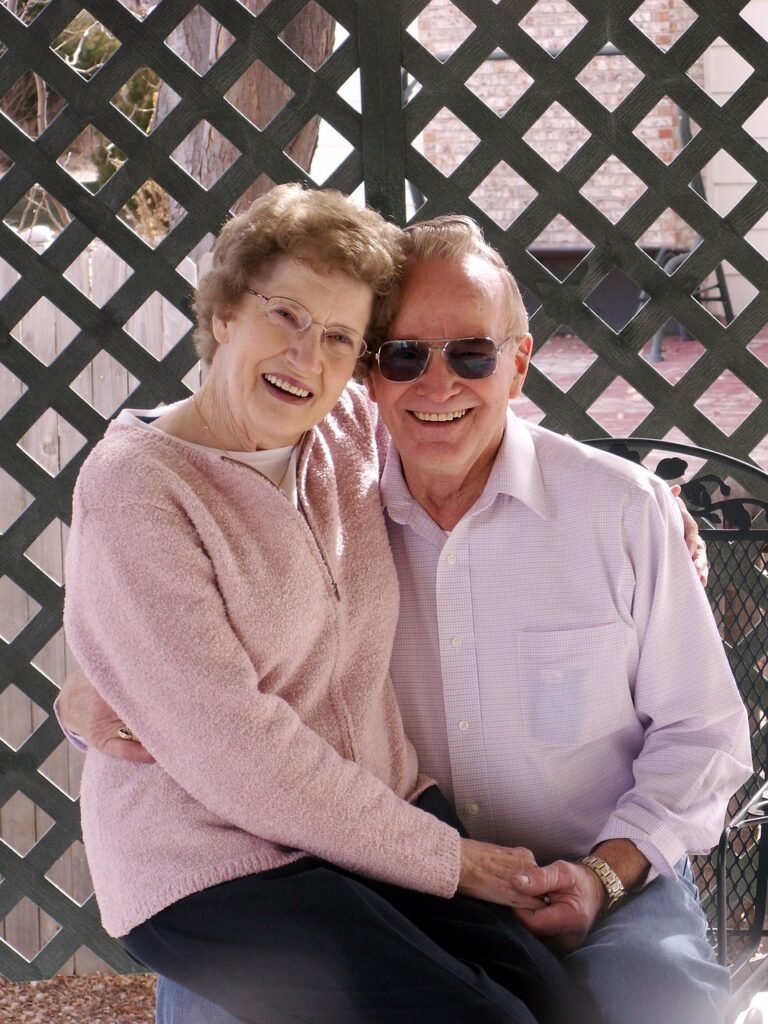

What our happy clients say

Jeremy W.I couldn’t be more impressed with the service and expertise provided by Harry. From our first meeting, they took the time to understand my financial goals and created a personalized plan that made me feel confident and in control of my future. He explained everything clearly, answered all my questions with patience, and provided valuable insights I hadn’t considered before. Whether it’s investments, retirement planning, or budgeting, I feel like I’m in great hands. Financial planning and advising has been made easy and straight forward with Harry being so open, transparent and honest about my situation itself. I truly appreciate his professionalism, transparency, and genuine care for my financial well-being. Highly recommend to anyone looking for trustworthy and knowledgeable financial guidance!read moreread less

Jeremy W.I couldn’t be more impressed with the service and expertise provided by Harry. From our first meeting, they took the time to understand my financial goals and created a personalized plan that made me feel confident and in control of my future. He explained everything clearly, answered all my questions with patience, and provided valuable insights I hadn’t considered before. Whether it’s investments, retirement planning, or budgeting, I feel like I’m in great hands. Financial planning and advising has been made easy and straight forward with Harry being so open, transparent and honest about my situation itself. I truly appreciate his professionalism, transparency, and genuine care for my financial well-being. Highly recommend to anyone looking for trustworthy and knowledgeable financial guidance!read moreread less Marie H.We have known Harry Hagias for several years as he was our financial advisor at NAB. He was always informative regarding our finances and investments. As we trusted him implicitly, when he moved on from the bank, we followed him. We find him approachable and trustworthy. Consequently we are more than happy with his services and advice.read moreread less

Marie H.We have known Harry Hagias for several years as he was our financial advisor at NAB. He was always informative regarding our finances and investments. As we trusted him implicitly, when he moved on from the bank, we followed him. We find him approachable and trustworthy. Consequently we are more than happy with his services and advice.read moreread less Pete H.Harry is the experienced professional you should seek to manage your investments and your future financial aspirations. Harry has the industry knowledge to set out all the options in a calm, honest and plain language manner that provides investment confidence. We consider Harry an authentic expert and value his insights, integrity and the personal attention to our discussions. Money Path is highly recommended and should be your financial investment first choice.read moreread less

Pete H.Harry is the experienced professional you should seek to manage your investments and your future financial aspirations. Harry has the industry knowledge to set out all the options in a calm, honest and plain language manner that provides investment confidence. We consider Harry an authentic expert and value his insights, integrity and the personal attention to our discussions. Money Path is highly recommended and should be your financial investment first choice.read moreread less Michael C.Harry has been looking after my wife and my financial affairs for many years. He is a consummate professional and has assisted our super growth in since rolling it over after retirement.

Michael C.Harry has been looking after my wife and my financial affairs for many years. He is a consummate professional and has assisted our super growth in since rolling it over after retirement.

He is thorough and fees are very competitive. He regularly organises meetings with us at our residence which we find much easier than heading into town.

I can ,with hand on heart ,thoroughly recommend Harry to anyone looking for a long term professional financial planner .read moreread less Michael S.I am totally at ease with Harry Hagias as my Senior Financial Advisor. He explains everything at a level that sits comfortably with me. His recommendations and reasons for adjustments to my portfolio are walked through in an absolute transparent manner in my Record of Advice that I take away with me at the end of the day. It's so reassuring to know that my goals and objectives are being achieved and met with what I must say is a very modest annual advice fee to match.read moreread less

Michael S.I am totally at ease with Harry Hagias as my Senior Financial Advisor. He explains everything at a level that sits comfortably with me. His recommendations and reasons for adjustments to my portfolio are walked through in an absolute transparent manner in my Record of Advice that I take away with me at the end of the day. It's so reassuring to know that my goals and objectives are being achieved and met with what I must say is a very modest annual advice fee to match.read moreread less